A USDA financing was a government-supported financial built to assist foster homeownership in outlying elements

Supported by the latest U.S. Agency of Farming (USDA), such money don’t need an advance payment, however, there are rigorous money and you may venue conditions borrowers must fulfill so you can meet the requirements.

Documents criteria: Every candidates should bring proof of their residence status since the You.S. noncitizen nationals or licensed aliens.

Traditional funds

A normal mortgage was any financial this is not supported by a national institution. Old-fashioned finance commonly wanted high minimum credit ratings than government-backed loans and so are often more strict when it comes to appropriate debt-to-income percentages, deposit amounts and financing limits.

Records criteria: Borrowers must bring a valid Public Cover matter or Individual Taxpayer Identity Matter along with proof the current home updates through an employment agreement document (EAD), eco-friendly cards otherwise works charge.

Non-QM funds

Non-qualified mortgages https://www.elitecashadvance.com/personal-loans-nj/kingston/ is lenders you to are not able to meet with the User Economic Safety Bureau’s capability to pay-off rule, or needs one lenders opinion an excellent borrower’s funds and place mortgage terminology they are gonna pay-off. These types of money are usually available to consumers whom are unable to qualify for antique funds, usually because of poor credit, as well as incorporate highest interest rates, higher downpayment minimums, initial charges or other can cost you accredited mortgage loans don’t have. As well as often are uncommon have such as the capability to make attract-merely repayments otherwise balloon repayments.

Qualified immigration statuses: Even international nationals is qualify for non-QM funds, as many of these loan providers do not require proof of U.S. income, U.S. borrowing otherwise a social Defense count.

Documents standards: You generally don’t have to offer one evidence of U.S. residence reputation or a personal Coverage matter, and instead possible just need to meet the lenders’ income, deals or other important requirements.

step three. Collect files

Like most homebuyer, just be willing to show your income, property, advance payment supply and you may credit history. Additionally, possible generally need to bring records of your residency standing in order to mortgage brokers. We have found a list of well-known private information having within ready:

> Social Shelter matter: Most bodies and you will old-fashioned lenders need a legitimate Societal Cover count to meet the requirements. In some cases, just one Taxpayer Identity Amount is welcome, however, generally Public Safeguards wide variety is actually well-known.

> Residency: Lenders like to see appropriate, unexpired proof your property condition in the You.S. This means legal permanent residents will have to provide their environmentally friendly notes and you may nonpermanent citizens will need to inform you its visa or employment consent document.

> Deposit within the U.S. dollars: Currency for your advance payment and you can closing costs must be in U.S. bucks when you look at the an excellent U.S. checking account. When the those funds originally originated from a different account, you’ll want to promote proof of its exchange so you’re able to U.S. bucks. Lenders love to find a typical equilibrium for around two months before the application.

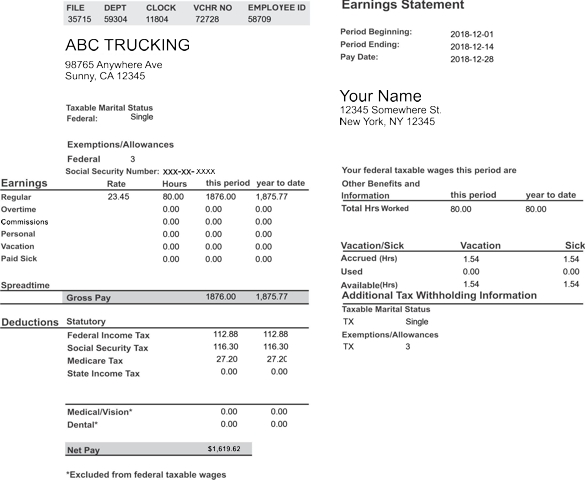

> Earnings inside U.S. dollars: Anticipate to let you know lenders at the least during the last a few years’ earnings records, constantly courtesy W-2s or government tax statements, and you can establish current a job. One payments or income obtained away from a foreign business otherwise a great foreign bodies within the yet another money must be interpreted so you can dollars.

> Credit score: Loan providers will look at your You.S. credit rating and you may credit report from just one or maybe more of three national credit reporting agencies: Experian, Equifax and you can TransUnion. When your credit is just too the new because of insufficient enough U.S. credit score, your lending company can use credit records off a different country, given they meet up with the same criteria to own home-based account and tend to be able to be translated towards English. Loan providers also can undertake a great nontraditional credit score, like the previous a dozen months’ lease or electricity costs.