Homeownership to possess Pros: Beating Economic Hurdles in Nows Housing industry

Of several pros think homeownership an obligations and you will a significant symbolization of your balances and cover they have struggled to make certain. However, this new path to this promise relates to particular difficulties, particularly in this today’s very competitive and you may actually-more-expensive housing sector.

This functions discusses veterans’ financial challenges with the family purchases and you may delivers solutions to assist them to ideal would these issues.

An approach to Overcome Monetary Challenges

Even after such obstacles, pros have many strategies and you can info as they work at having a property. These types of devices and techniques to allow veterans to find out homeownership effectively.

Approaching Loans and you can Improving Credit

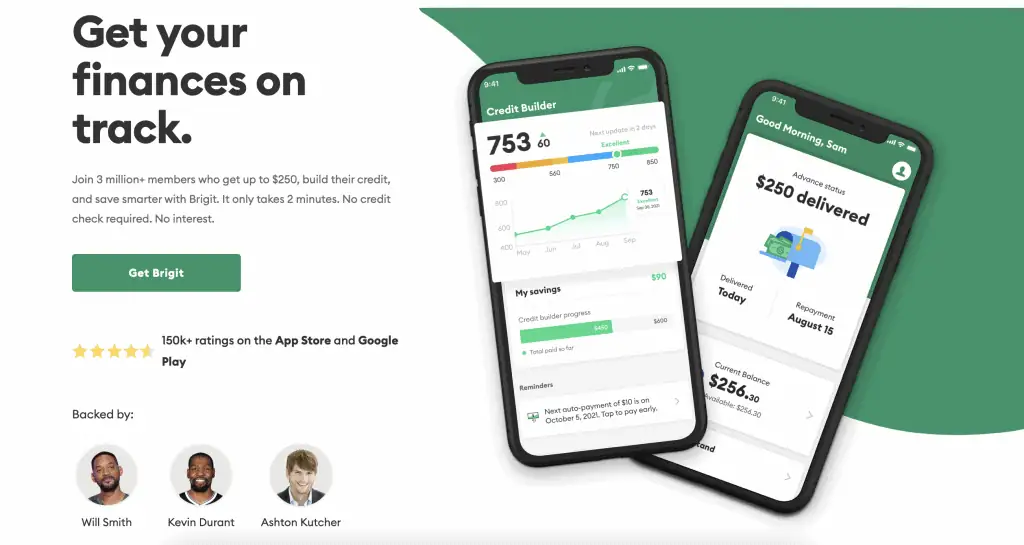

Handling most recent expense can be the original essential step towards to order a property. Veterans enjoys a few options because of it. Of several nonprofit organizations submit borrowing from the bank guidance properties designed specifically for veterans’ means. Personal debt management would-be crucial for achieving best credit scores thanks to apps.

Pros must think aVA debt consolidation reduction financing. Such selection can enhance percentage and reduce interest rates, alleviating financial obligation burdens. It is best to work with higher-notice expenses 1st if you’re becoming newest that have minimum costs with the almost every other bills.

Credit history critiques frequently are essential. Pros must build examining their credit file in some instances and you may restoring mistakes immediately program choices. This type of convinced ahead’ strategy can enhance credit scores, that is essential obtaining glamorous financial choices.

Using Virtual assistant Financing Benefits

The fresh new Va financing program will bring big pros one to pros is to totally play with. Positives is zero downpayment criteria to possess being qualified loans, a prevention out-of private home loan insurance (PMI), and you may beneficial interest levels.

Veterans looking to get one particular advantages is to secure its Certificate of Qualification at the outset of property. According to the Virtual assistant, this file is important to possess getting Virtual assistant loan benefits. To change efficiency, handling loan providers one to really worth Va money is very important simply because they are entirely familiar with the system facts.

Experts is to take care to learn about new Virtual assistant resource commission therefore the available exemptions. Foresight on the such economic will cost you helps with your financial allowance and you may economic plan as you improve in home to find.

Cost management and Preserving Measures

Controlling homeownership will set you back needs active cost management. Armed forces group are able to use various budgeting software and you will info produced specifically in their eyes. These types of tool can also be help constructing fundamental finances and you can overseeing expenses effortlessly.

Making offers to own emergencies and you may closing costs automatic might be a great strategic circulate. Starting automated transfers to help you discounts account can cause a continuous roadway to the financial requirements without having any repeated manual input.

Experts is to opinion the brand new solutions provided with company coordinating applications having old-age offers. Enhancing this type of pros you’ll let them earn more getting construction expenses if you’re sustaining its economic future.

Contrasting So much more Financial assistance Apps

And additionally Va finance, experts s. Certain says bring property arrangements getting pros that include additional provides or low-notice loans. Va masters can complement these types of programs, increasing option of homeownership.

Of many localities render advance payment advice programs one work with veterans. More over, loads of lenders have tailored financial factors ideal for veterans’ variety of requires. Exploring such choice may lead to newly receive ways to resource property buy.

Knowledge and you may Guidance

Knowledge serves as a powerful virtue during the home-to get procedure. To assist pros succeed in homeownership, 100 % free homebuyer degree courses arrive, some of which is distinctively readily available for all of them. These types of programs offer trick understandings of the house-to buy feel and money government.

One-on-one counseling provide official assistance in suggestions out-of casing masters certified of the You.S. Department from Casing and Urban Advancement (HUD). Having this type of masters to help pros which have housing marketplace complexities can result in ideal decision-and then make.

It is extremely vital that you learn field style while the costs out of home ownership within designed locations. Experts normally most useful choose when and where to purchase through this long lasting knowledge.

Bringing a handle toward County of the Most recent Housing market

New You.S. housing industry has already identified reatically and you will collection however reduced in several nations. Transitioning veterans can find the latest trials out of handling solution costs and the latest better products away from Va mortgage measures a little daunting on these sector conditions.

Knowing the System

In the last very long time, the newest U.S. housing sector indicates better progress, that have large goes up in home viewpoints and limited inventory offers from inside the multiple section.

Referring to the alteration to life outside of the armed forces, sorting as a result of services costs, otherwise understanding the challenging Virtual assistant loan program can make field trends particularly problematic to have pros.

Key Challenges Veterans Deal with

On their road to homeownership, veterans stumble on numerous uncommon obstacles. People which over their services is within the weight out of substantial loans, along with figuratively speaking, bank card stability, or unsecured loans lent during deployments. These types of established resources of loans is strongly apply at the personal debt-to-money ratio, that is a key factor in brand new acceptance away from mortgage loans.

A separate issue considering credit scores ‘s the profile out-of armed forces services, that could involve unexpected deployments and frequently demands relocation. It’s possible to skip payments otherwise discover mistakes inside credit history. These problems can aid in reducing fico scores, it is therefore more challenging to get to tempting financing words.

Income monitors demand an additional amount of difficulty. During the transitioning so you’re able to civil specialities, pros could possibly get struggle to showcase the common long-name money history finance companies come across. This will improve home loan software procedure more complicated and you will drop off their solutions.

When you’re Va funds benefit veterans off zero down-payment, they nonetheless struggle with the requirement to accumulate dollars having closing will cost you and build an emergency fund. Strengthening financial thinking is very important but complicated, especially for the individuals simply creating the civil careers.

Finally, although providing multiple professionals, acquiring a good Virtual assistant loan have specific laws and regulations and you may prerequisites. This might be confusing, particularly for people to shop for property for the first time and unfamiliar with the genuine home ecosystem.

Seeking to the long run

Into the growth in the genuine home globe, policymakers and you will financial institutions have to know and you will target exclusive barriers veterans come upon whenever getting homeownership. Currently, you will need to bolster economic knowledge programs to have provider users cash converters second chance loan in order to enable them to better plan to find a house when that time appear.

This energy will ease the fresh Va financing acceptance procedure and you can make certain resources to assist veteran people thrive within the easily altering industry surface. Additionally covers expanding investment to own apps that provides off commission help experts.

Achievement

The present markets brings up demands to own pros struggling to own a house, however, homeownership remains achievable. Attention to barriers, use of readily available resources, and you can application of hands-on economic methods help pros it’s build homeownership possible.

With the travels, one needs persistence, mindful think, and also the ability to survive-services one vets exemplified during effective services.

Thinking about experts inside their travels getting safe and you can less costly property as a way to give thanks to all of them for their work is essential. Nonetheless, in addition it stands for a life threatening funding in the manner durable and you can steady the groups feel.

The point inside working to improve and you will increase veteran homeownership apps is to try to demonstrated the thank you for their sacrifices which help all of them in their profitable changeover of military in order to civil lives.