Plain English guide to conditions youll pay attention to from your loan manager

You can find those acronyms and you will abbreviations your loan administrator iliar to you personally. Lower than we outlined the most common of these to own site, but contemplate:

- You shouldn’t be threatened, plus don’t forget to inquire of the meaning of every title you do not see.

- Asking for explanation will help you to feel positive that youre putting some right conclusion regarding your financial.

- Familiarizing yourself with the principles will help you express top which have one loan professional.

Financing administrator alphabet soup: terminology you are able to pay attention to

I? MIP? Your mortgage loan manager may appear like they swallowed a number of Scrabble ceramic tiles, nevertheless these try actual conditions. Words you will need to know after you make an application for a house financing.

Meanings out-of prominent home loan terminology

Very first, if the loan manager is throwing around all sorts of jargon without any need, you’re not the one to your condition – they are. Avoid being intimidated, you shouldn’t be afraid to inquire about the meaning of any title you don’t know. Yet not, once you understand such axioms will help you to communicate better having any loan professional you employ.

Varying Price Mortgage (ARM)

Variable price mortgages function down rates than repaired-speed mortgage brokers. However, after a basic chronilogical age of one-to-a decade, the speed for these loans resets, otherwise changes. Which makes all of them riskier in order to consumers than repaired-price loans. People that intend to own their homes for more than a long-time can be better off having a predetermined-rates financial, or FRM.

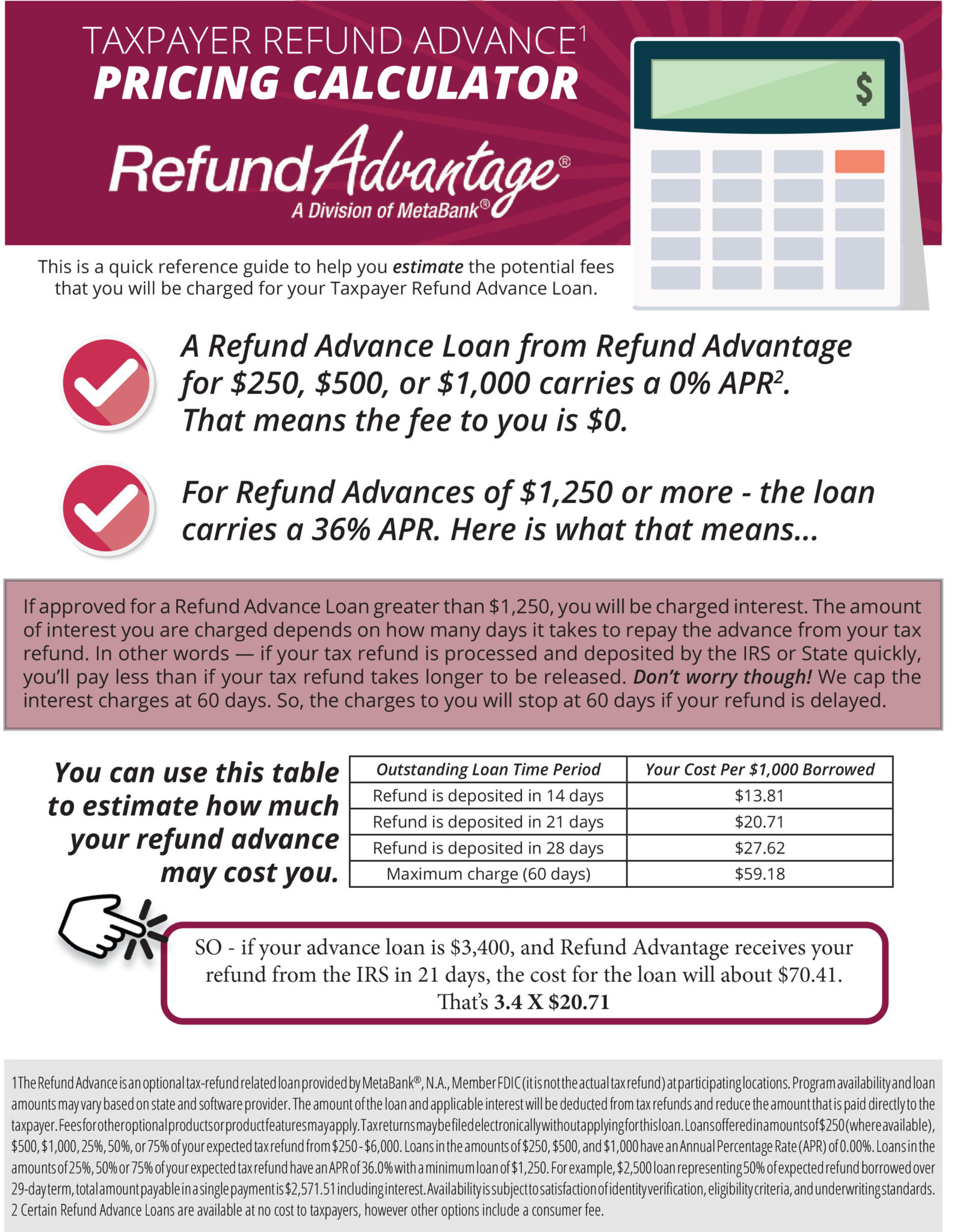

Apr (APR)

The latest Annual percentage rate refers to the total price out-of credit, conveyed since the mortgage. That implies not just the interest might spend. It gives the lender charges too. The brand new APR’s purpose would be to create looking for home financing much easier. As an instance, what exactly is a better bargain – good cuatro.5 per cent 30-year loan costing no situations otherwise charges, or a beneficial 4.0 % mortgage charging a couple factors? Apr will reveal. In such a case, the newest Apr into the earliest loan is 4.5 per cent, and for the next home loan, its cuatro.165 per cent.

Amortization

Amortization ‘s the fees off financing – the latest allowance interesting and you will prominent as you pay your loan every month. After the interest due is actually deducted, the remaining amount of your fee visits reducing the principal harmony. Each month, the balance are some straight down, thus quicker desire is due. Throughout the years, more info on of your commission visits prominent, much less must cover focus, until what you owe inside zeroed plus loan try paid back.

Appraisal

An appraisal are a research prepared by a licensed appraiser. Mortgage brokers require it to choose the value of the house he or she is credit up against.

Capacity to Repay (ATR)

The brand new ATR provision of the Dodd-Frank Act need mortgage brokers to confirm one to individuals are able the brand new costs when they’re accepted to own a home loan. Which means earnings have to be verified.

Closing costs

They are the fees one people spend once they buy assets. They might tend to be possessions import taxes, home loan company charge, fees so you can 3rd party team also to government

Closure Disclosures (CD)

This is your last number of records after you intimate an excellent loan places in Meeker home loan. They change the dated HUD-1 setting. Such disclose new terms of the loan and its particular can cost you. It has to fulfill the latest Mortgage Guess you acquired after you locked their interest.

Debt-To-Income Proportion (DTI)

This is actually the matchmaking involving the income and you may month-to-month obligations costs. It’s your costs such as for instance mortgage repayments, car loan payments, figuratively speaking, handmade cards, etcetera., separated by the disgusting (prior to income tax) money. Mortgage lenders favor DTIs not as much as 41 percent.